Introduction

Across the 2 February 2015 and 16 February 2015 releases of Class, new functionality was made available that allows Class users to better handle Foreign Assets. This includes foreign bank accounts, foreign securities from 8 overseas markets and exchange rates for 20 currencies.

Instead of building new screens for everything foreign, Class has integrated the new features into the existing screens making the end user experience one that is familiar. Users just need to toggle the “foreign” checkbox to expose the new features when it comes to setting up bank accounts, setting up securities and processing transactions.

Foreign Bank Accounts

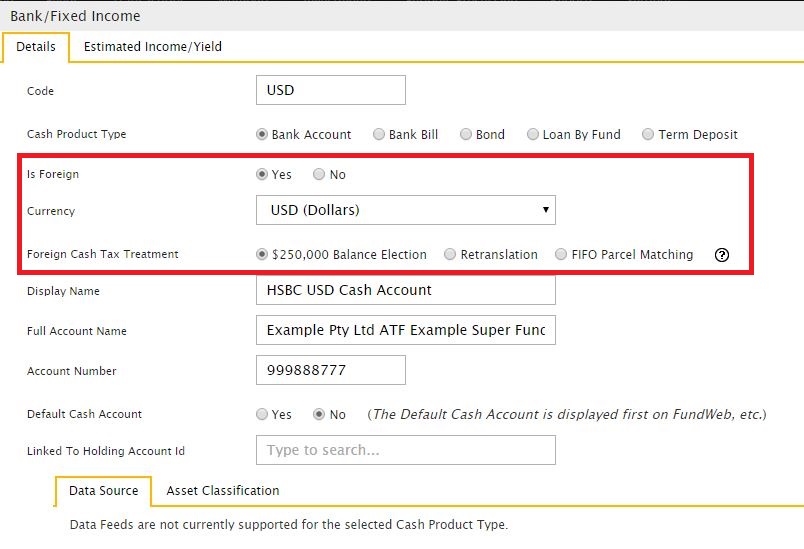

Setting up a Foreign Bank Account is similar to setting up an AUD account except with two new fields where you indicate the Currency and the Foreign Cash Treatment.

Class has provided flexibility when it comes to the accounting and tax treatment of foreign bank accounts by offering three Foreign Cash Treatment options: $250,000 Balance Exemption Election, Retranslation Election, and FIFO Ordering. Having been involved in different businesses over the years, I have seen the different options applied, so it is great to see the different options made available to be used with a simple selection upfront.

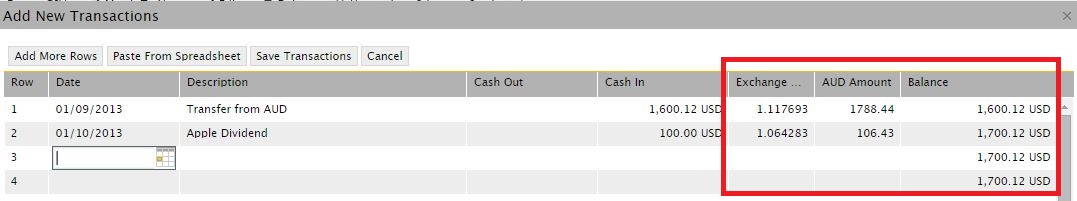

Entering the foreign cash transactions uses the same screen as AUD accounts –the Bank Statements page. The difference when adding in a new transaction for the foreign bank account is that you are provided with the Exchange Rate for the entered day and the calculated AUD Amount for the entered foreign amount (which you can override).

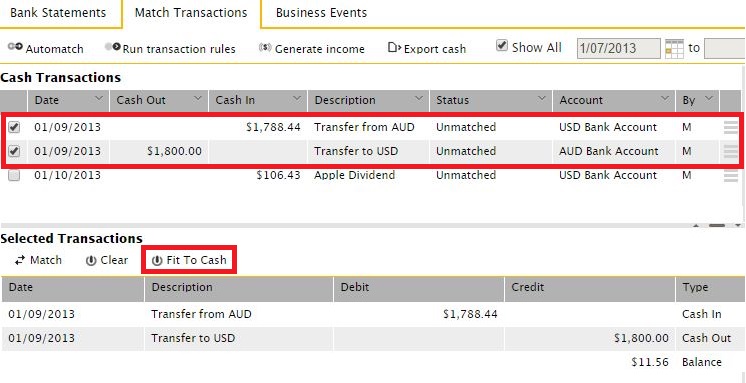

As can often be the case, if the exchange rate provided by Class does not match exactly with what occurred with the actual transaction, the “Fit to Cash” functionality on the Match Transactions page will adjust the exchange rate used to make the transactions match. Once again, the “Fit to Cash” functionality is familiar to Class users, currently being used for matching Income Events created by the Generate Income function where rounding differences exist of less than $1. This has now been extended to apply to foreign transactions but with no dollar restriction.

Foreign Securities

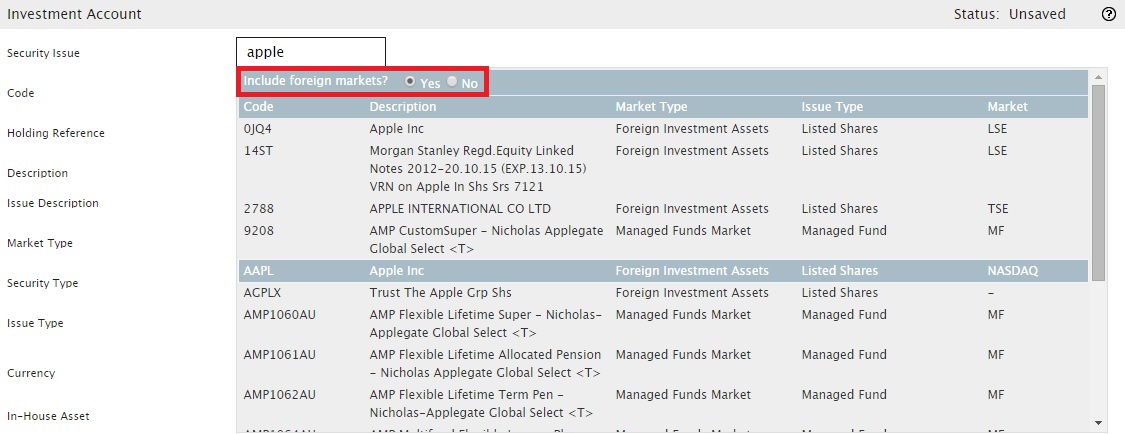

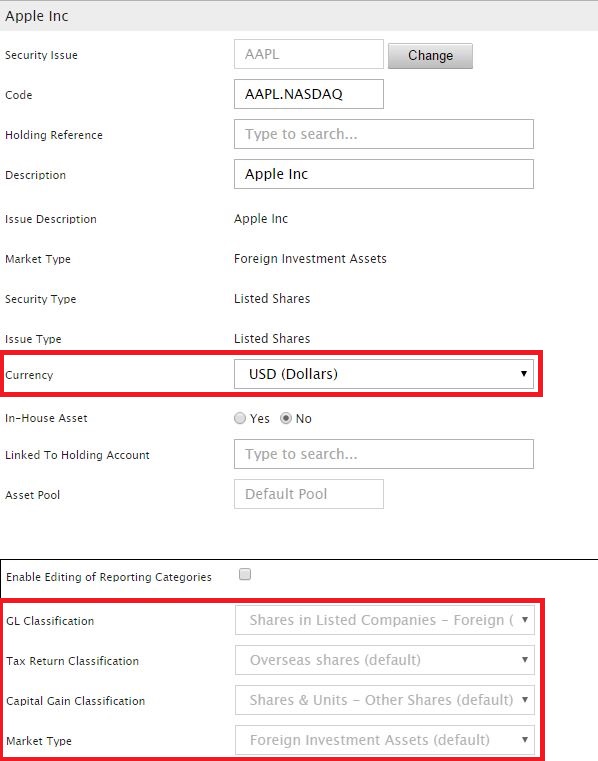

Setting up Foreign Securities uses the same new Investment Holding Account screen as AUD securities. When searching for the security to link to, you can choose to include foreign markets. Be careful when choosing a foreign security from the list as often securities with the same name may be on two or more markets, therefore pay special attention to the Code and the Market.

The Currency of the selected foreign security is known by the system however you can override this if required. The Reporting Categories (for accounting, tax, CGT and investment reporting) should all be set correctly for your foreign security.

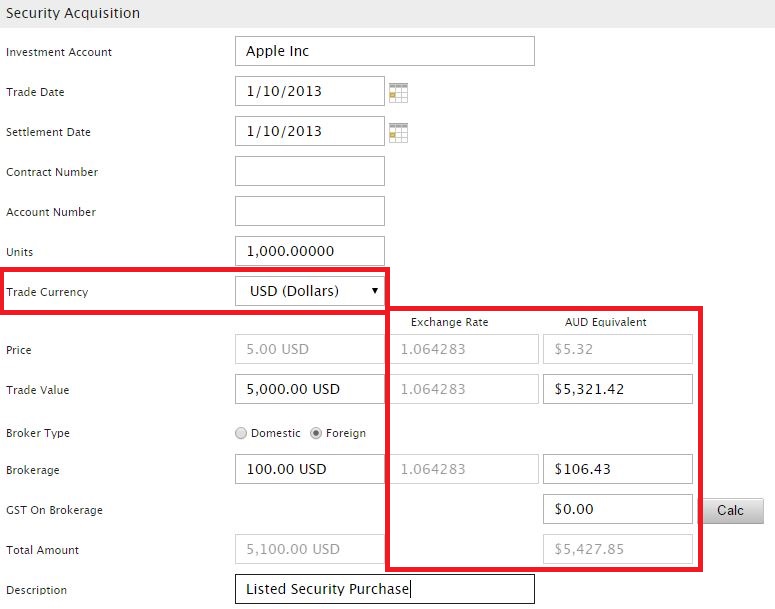

When processing the purchase or sale for a foreign security, the additional inputs for foreign will be presented to the user after they select a foreign security in the Investment Account dropdown. Once again it is similar to the AUD equivalent, except extra fields for the Exchange Rate and the AUD Equivalent amount.

Class is also receiving corporate actions like dividends, splits, consolidations and capital returns for foreign securities, so make sure you use the Generate Income function and the Corporate Actions console for funds with foreign securities too.

Reporting

The common theme so far is how Class has integrated the new foreign assets functionality into the existing screens and functions. Where this does not apply is for Reports. Class has decided to release three new reports for foreign assets that reconcile the foreign amounts to their AUD equivalents:

- Foreign Asset Worksheet

- Foreign Income Worksheet

- Foreign Bank Account Movement Report

NB: At the time of writing this, the above reports were “Coming Soon” to Class.

If Class had tried to add new information to the existing reports, it would have been to their detriment. With so much data (rightly so) exposed on existing reports, adding extra columns for the Exchange Rate and AUD Equivalent would have been impossible. I am hearing that the new reports are easy to read and provide the extra information required where Foreign Assets are present in the fund.

Conclusion

As Class daily processors, Super Know How has had to deal with funds with foreign assets regularly. In the past we would have completed calculations outside of the system, converting foreign amounts to AUD before keying them into Class. With this new functionality, the calculations outside of the system no longer need to be completed with the entire job being completed within Class. The user input screens are just expansions on existing screens, so it is all familiar and easy to start working with.

As SMSF Auditors, Super Know How has had to audit funds where the administrator/accountant has had to reconcile the foreign transactions outside of the system. This resulted in a less efficient audit as we had to review these extra manual calculations completed in a spreadsheet. Now with it all in Class, we can focus on Class solely for the audit of funds with Foreign Assets.

While you may be thinking that your funds with Foreign Assets make up only a small proportion of your overall client base, it would be naive to think that this area will not grow in the coming years with technology advances bringing major countries and their markets closer together. Having the Foreign Assets functionality will allow you to take on this expanding area without impacting the performance and efficiency achieved through Class.

Training

Class offer complimentary live training sessions for all registered Class Users. Super Know How run these training sessions via Web Conferencing each week. We discuss Foreign Assets in Module 5 so please register to see more on the above process or to ask any questions that you may have on this. http://www.classsuper.com.au/training/registration/

Who are Super Know How

Super Know How have been intimately involved with the development of the Class Super software since its earliest stages. As such, we understand the power and inner workings of the Class Super system.

We provide many services in the SMSF space including:

- Class Super Training

- Outsourced Administration and Tax Agent services

- SMSF Audits

http://www.superknowhow.com.au

Please follow us on LinkedIn for more Class updates:

http://www.linkedin.com/company/super-know-how

Or Twitter:

http://www.twitter.com/SuperKnowHowAu

Disclaimer

All data and information provided above is for informational purposes only. Super Know How makes no representations as to accuracy, completeness, currency, suitability, or validity of any information on this page and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

Comments are closed