Introduction

Across the June, July and August releases of Class new functionality was made available that allows Class users to electronically lodge Pay as You Go Withholding (PAYG-W) reporting with the ATO. This includes both pensions/income streams and lump sums.

The technology that Class uses for these lodgements is Standard Business Reporting (SBR) which is what their Activity Statement Lodgement functionality also uses. Please note that before you will be able to lodge using SBR you will need to ensure that you have your Tax Agent set up with an authorised Device AUSkey. Search for “AUSkey” in the Class User Guide for more details about setting this up.

What did we do previously?

PAYG-W generally only applies to pensions and lump sums received by payees under the age of 60. As such there is usually only a small subset of clients where we need to do this kind of reporting. We would run the applicable PAYG-W reports from Class and then complete the paper ATO forms much to the displeasure of our staff! As the ATO made electronic lodgment of this reporting difficult, I am sure plenty of other SMSF businesses were doing the same thing so this new feature from Class should provide significant relief for all.

Pensions/Income Streams

To complete the PAYG-W reporting for Income Streams, you firstly need to complete the processing of the Pension Drawdown events in Class. If the member needs PAYG-W Reporting lodged (Member received Taxable component when Under 60) then when you go to the Periodic Processing/Browse PAYG Lodgments page where you will see a record for the member(s) indicating that an Income Stream Lodgement is Required.

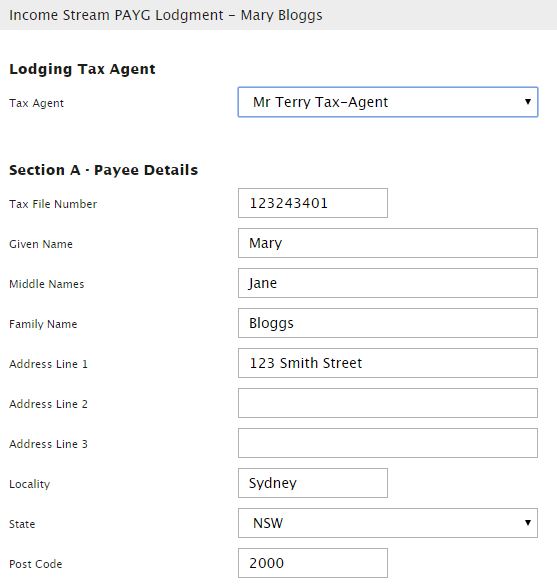

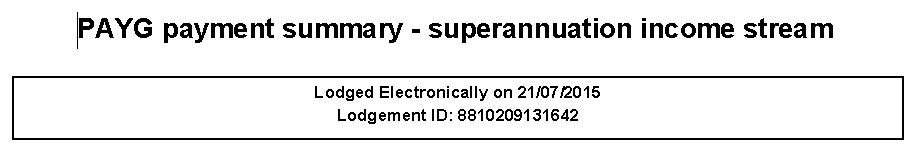

When you are in a position ready to lodge the PAYG-W reporting, select the record to show the details that you are about to lodge. You will be presented with the Payee Details and Payment Details as calculated by your processing in Class. Class allows you to edit these details before lodgment, just in case. Once you are ready to lodge, click the Lodge button and the submission will immediately go through.

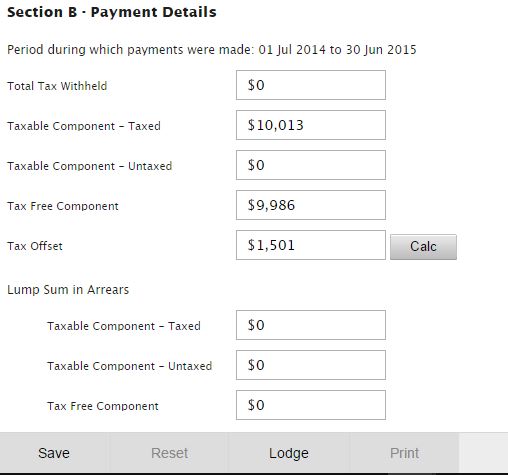

Once lodged, you can click the Print button from the same screen which will produce a PAYG Payment Summary – Income Stream form that you can send to the payee for their personal tax return, as well as adding to the fund’s audit file. The document printed will indicate the date lodged and lodgment ID at the top.

You can also generate this report from Reports/Run a Report/PAYG Payment Summary – Income Stream.

Lump Sums

The process for completing the PAYG-W reporting for Lump Sums is very similar to that of the Income Streams. There are two events that can lead to PAYG-W Reportable Lump Sums, and they are:

- Rollover/Lump Sum Out where the Payment Type: Cash; or

- Pension Commutation where the Payment Type: Cash Lump Sum

Once again, if the member needs PAYG-W Reporting lodged (Member received Taxable component when Under 60) then when you go to the Periodic Processing/Browse PAYG Lodgments page where you will see a record for the member(s) indicating that a Lump Sum Lodgement is Required. You can then complete the lodgement and produce the reporting from these screens.

One difference with Lump Sums is that you cannot generate the reporting from Reports/Run a Report – you can either do it from the Browse PAYG Lodgments screen or from the event itself that lead to the PAYG-W record.

Where to from here?

The most important improvement that I would like to see implemented is a screen at a Business level that shows you all funds in your business that require a PAYG-W reporting lodged. Otherwise you need to check each fund individually to do so.

Other less important improvements I can think of are:

- Ability to lodge amendments

- Ability to lodge all PAYG-W records for a fund with a single click, because at the moment you need to do one at a time.

Conclusion

As Class daily processors, Super Know How has had to manually lodge PAYG-W Reporting since the beginning of time. While the number of PAYG-W Reporting lodgements that we do each year is proportionally small against our overall number of clients we look at, the process of completing the job manually was dreaded and had the potential for human error. Having the electronic PAYG-W Reporting functionality will allow us and all Class users to gain further efficiency with their SMSF business.

As SMSF Auditors, Super Know How has had to audit funds where the administrator/accountant often forgot about the PAYG-W Reporting requirement. Having the functionality to quickly and easily fulfil this requirement, should eradicate this problem.

Training

Class offer complimentary live training sessions for all registered Class Users. Super Know How run these training sessions via Web Conferencing each week. We discuss Pensions and Lump Sums in Module 4 so please register to see more on the above process or to ask any questions that you may have on this. http://www.classsuper.com.au/training/registration/

Who are Super Know How

Super Know How have been intimately involved with the development of the Class Super software since its earliest stages. As such, we understand the power and inner workings of the Class Super system.

We provide many services in the SMSF space including:

- Class Super Training

- Outsourced Administration and Tax Agent services

- SMSF Audits

http://www.superknowhow.com.au

Please follow us on LinkedIn for more Class updates:

http://www.linkedin.com/company/super-know-how

Or Twitter:

http://www.twitter.com/SuperKnowHowAu

Disclaimer

All data and information provided above is for informational purposes only. Super Know How makes no representations as to accuracy, completeness, currency, suitability, or validity of any information on this page and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

Comments are closed