Introduction

In the 29 September 2014 release of Class, new functionality was made available that allows us to process the portfolio effect only of a corporate action. This is to be used while we are waiting for the corporate action details to be finalised/confirmed. This will enable SMSF Administrators undertaking daily processing to process the corporate action in an interim state that will result in them being able to continue the administration of the fund normally including:

- reporting correct investment balances to the trustee and adviser via FundWeb;

- using the Balance Reconciliation functionality for feeds from brokers and wraps/platforms; and

- using the Generate Income process based on accurate investment positions.

I would like to point out that the finalisation of a corporate action usually occurs as a result of one or more of the below documents being issued:

- an ATO Class Ruling;

- Company ASX announcement; or

- Share Registry documents.

It can take the ATO many months or even years to issue their class ruling in relation to these corporate actions, as we saw recently with the Westfield Group corporate action that occurred in June 2014, however it was not until October 2014 that the ATO issued its ruling. Prior to this new functionality, you would have needed to either:

- process the Corporate Action based on what was expected and then remember to update the transaction you processed once the class ruling was issued; or

- wait until the class ruling was issued, which would have meant that reports on FundWeb would have been incorrect and that Class functionality like Balance Reconciliation and Generate Income would not have been reliable for the affected holdings.

An Example

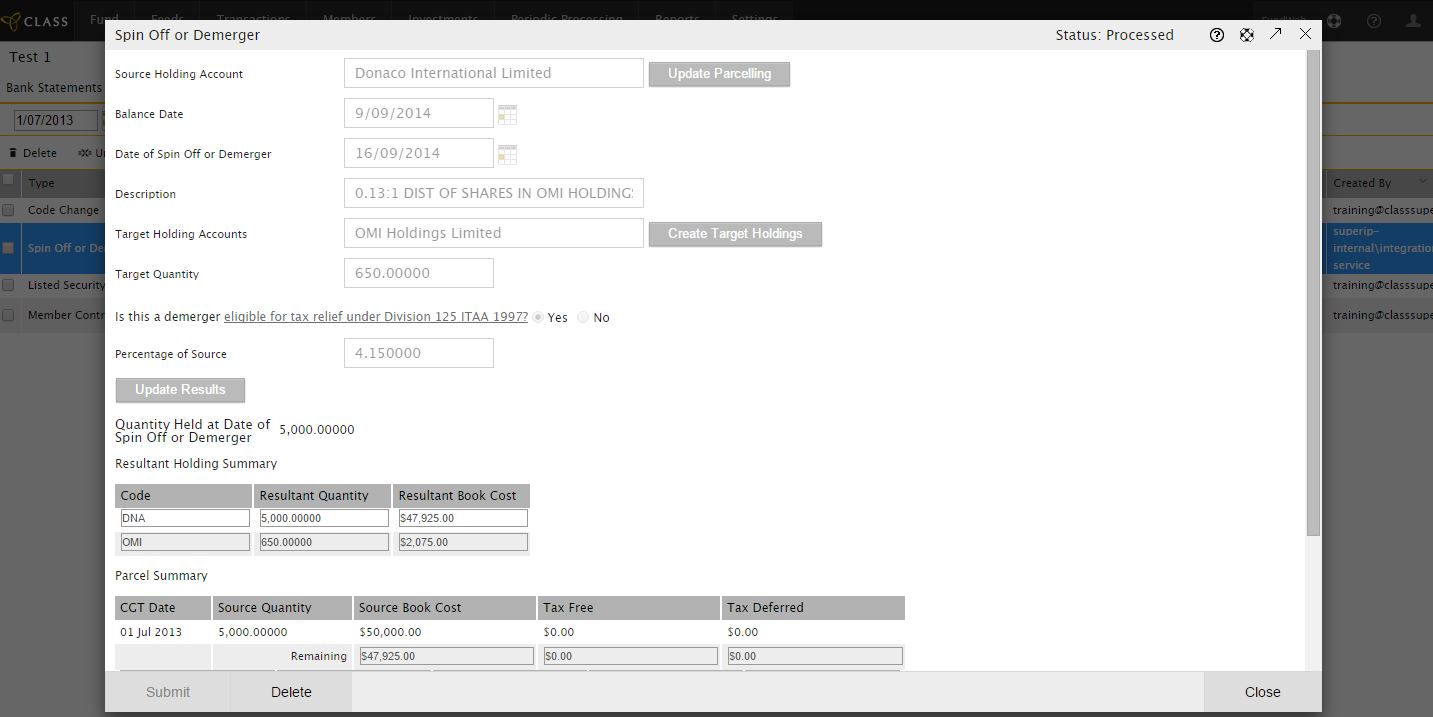

Let’s look at a real life example of a corporate action that is in this interim state. In September 2014, Donaco International Limited (DNA) was subject to a corporate action that resulted in shareholders of DNA receiving shares in OMI Holdings Limited (OMI) as a result of a 13:100 spin off. The ATO has only just recently issued the class ruling.

Portfolio Effect processing is something that you will most likely want to perform as a bulk action across all of your funds, and as such it is only available at a Business level through the Corporate Actions Console (under the Investments menu).

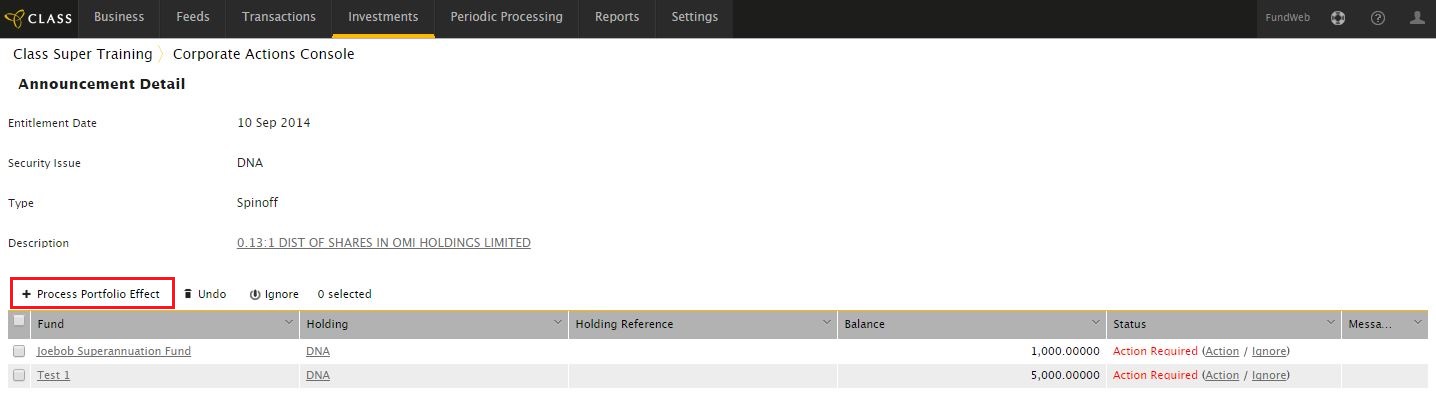

When you select a corporate action that is not finalised, you will see a “Process Portfolio Effect” button on the left hand side, whereas for a normal/finalised corporate action, it is called just “Process”.

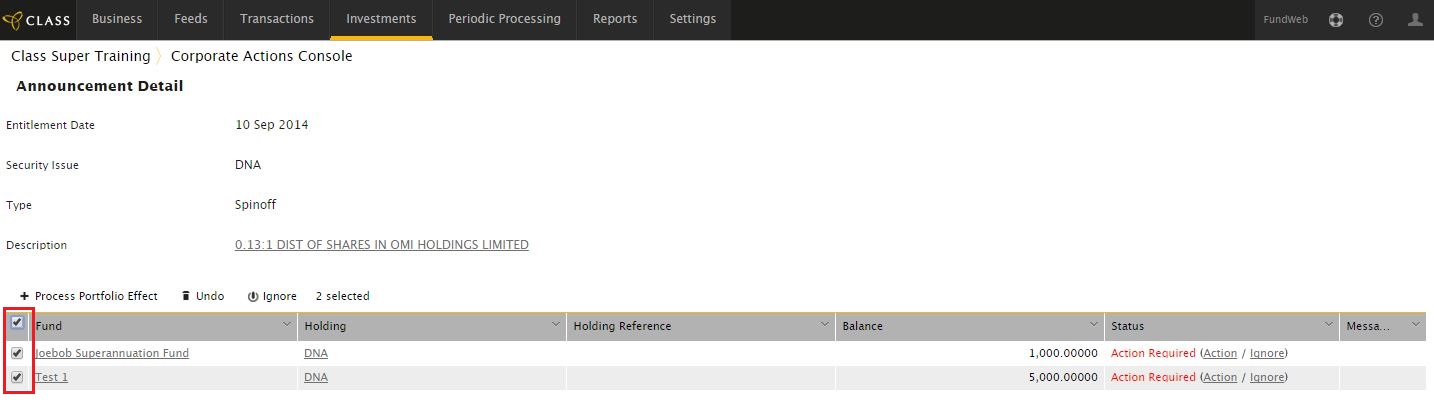

To use the process portfolio effect feature, just check the box alongside the fund(s) that you want to process it for, then select the Process Portfolio Effect button to continue.

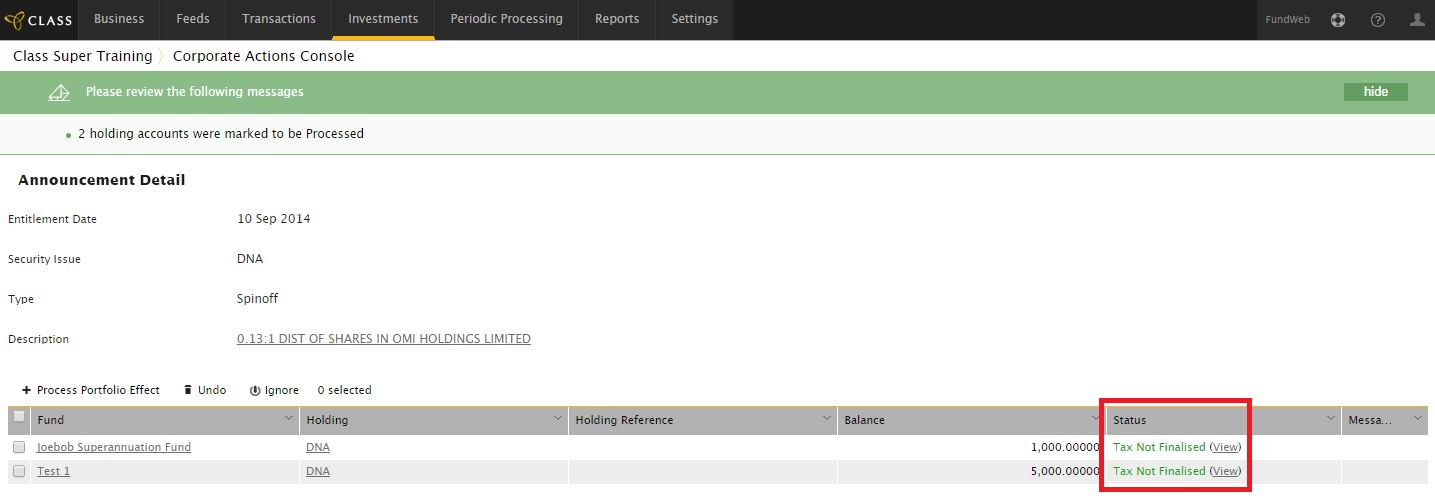

Within a few seconds, the events will have been created for each of the funds. The status of the event on the right hand side will have changed to “Tax Not Finalised” which is the completed status of an interim corporate action. (NB: the completed status of a finalised corporate action is “Processed”).

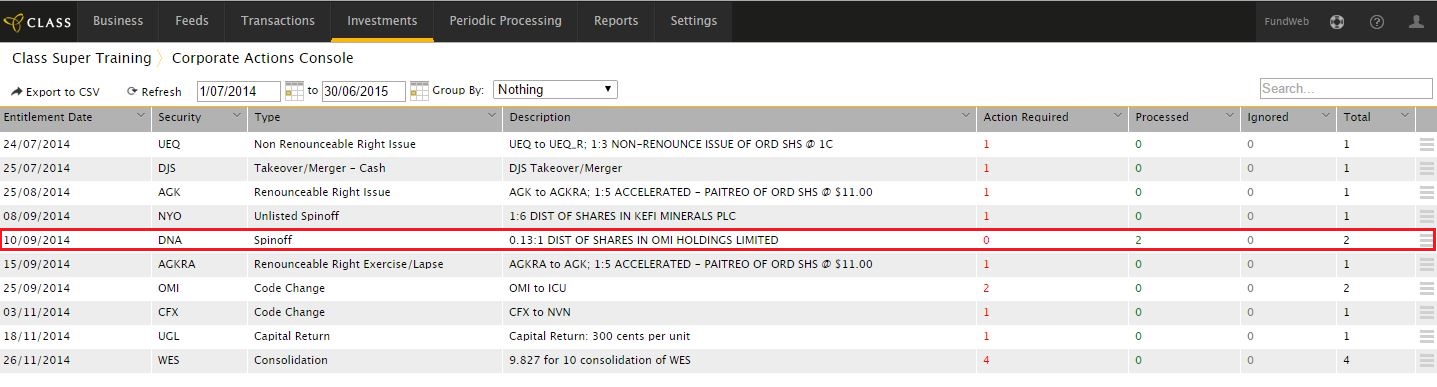

On the Corporate Actions Console, the corporate actions are marked as if they are Processed/Finalised.

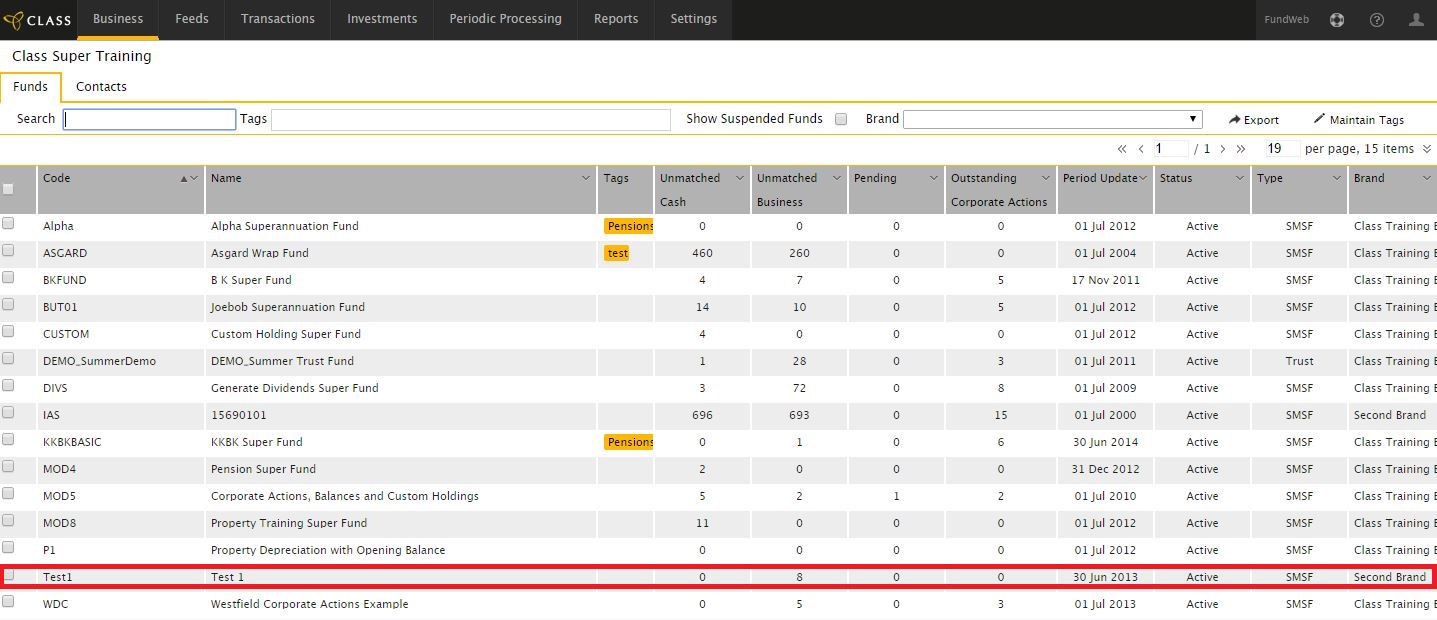

On the Browse Funds page, the corporate actions are marked as if they are no longer Outstanding.

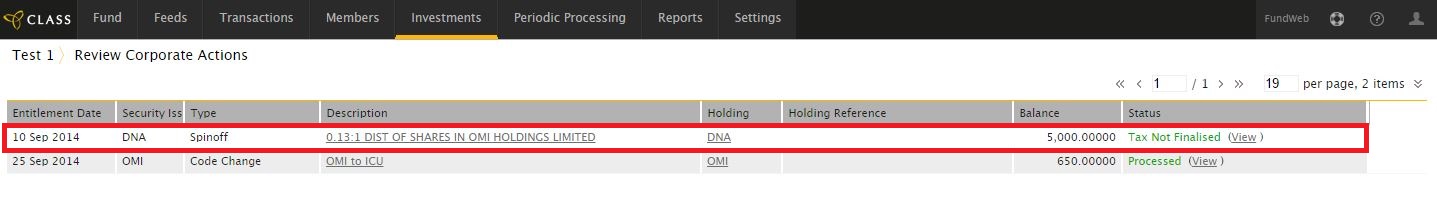

At the fund’s Browse Corporate Actions page (under the Investments menu) the corporate action shows with its status of “Tax Not Finalised”.

The event appears as a normal event under the fund’s Browse Events page. You will notice that the event is processed based on the corporate action’s currently known attributes regarding CGT consequences, etc. In our situation, 4.15% of the cost base of DNA was allocated to OMI.

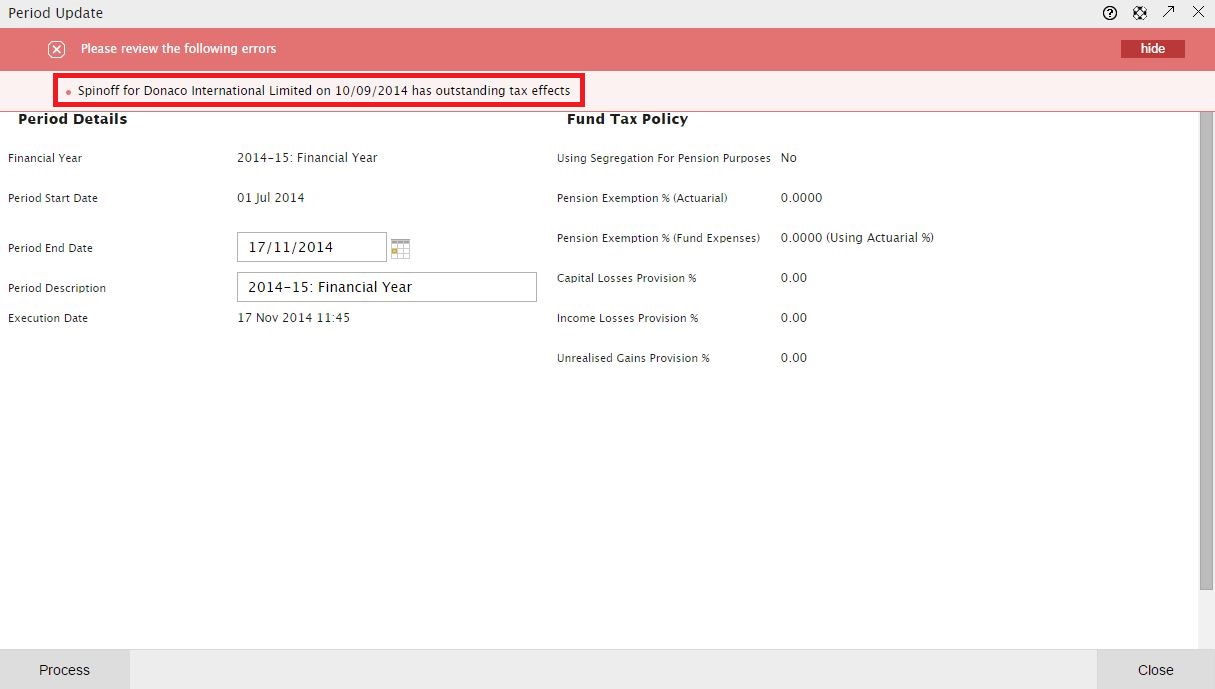

Interaction of Portfolio Effect Processing with Period Update

As Portfolio Effect processing is not processing a finalised event, Class has made it so that you cannot run Period Update across any period that has one of these corporate actions in this state. If you do try to, you will see this error message:

If this is in a year that you want to finalise the financials/tax/audit immediately, then you will need to consider whether you can do so based on the corporate action in its current state. To do so, you would need to delete the existing Portfolio Effect only event and then process the corporate action manually at a Fund scope. Obviously extra attention and care would be required if you choose to go down this path.

When the Corporate Action is Finalised

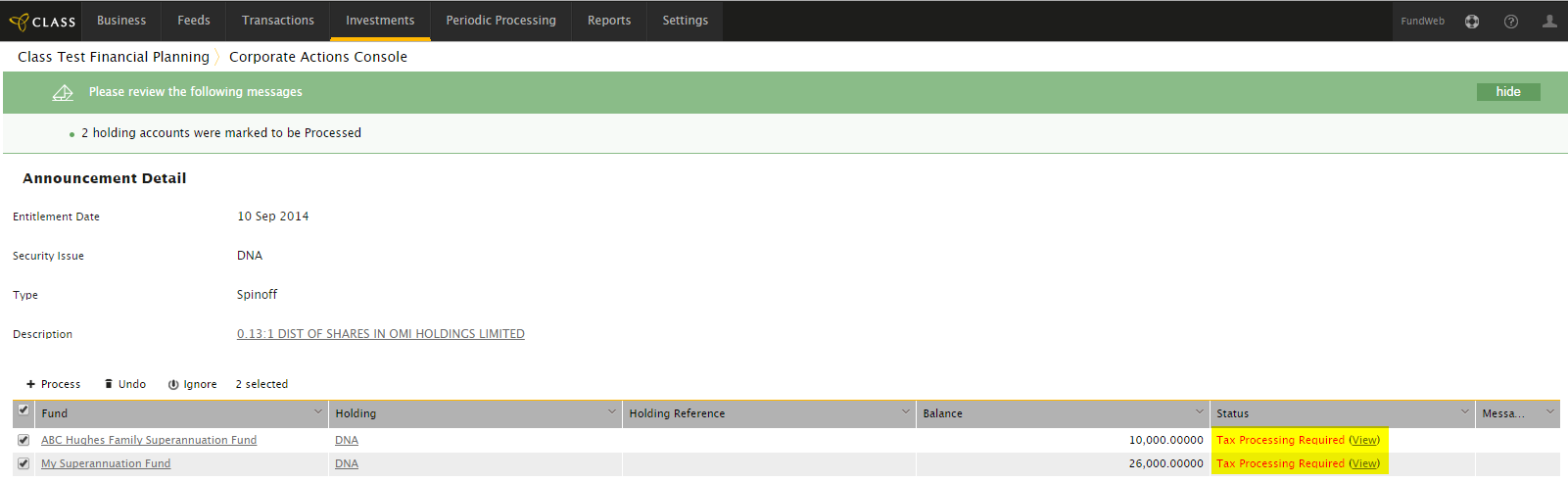

Once Class receives the finalised corporate action information, they then need to update the corporate action’s template in the system. The status of the corporate action will then change from “Tax Not Finalised” to “Tax Processing Required”. As such, the affected fund(s) will show with an outstanding corporate action on the Browse Funds page and Corporate Actions Console, prompting you to complete the corporate action.

Below is a screenshot of what this will look like via the Corporate Actions Console which I have taken from the Class User Guide:

Completing this process will delete the old Portfolio Effect only event and replace it with the new event based on the finalised template. You will now be able to run Period Update for the period that has this corporate action.

What to look out for

As mentioned in my introduction, you can only complete portfolio effect processing at a Business scope at this stage. It is not obvious to the user that a corporate action is not finalised if you are at the fund’s Browse Corporate Actions page. Then if you process the corporate action at a Fund scope, the corporate action event will not fall under the Portfolio Effect functionality (i.e. error when running period update and change of status when corporate action actually becomes finalised).

Conclusion

As Class daily processors, Super Know How has often been in the position where we have been waiting for a corporate action to be finalised. At times, we have processed the event based on known information at the time and then relied upon manual checks to remember to update the events. Other times we have waited till the corporate action is finalised, so while we waited our staff were inconvenienced during their daily processing. Now we will use the Portfolio Effect functionality and let Class manage this process for us with a few clicks of the button and visibility across all of the funds that we administer from a single screen.

Training

Class offer complimentary live training sessions for all registered Class Users. Super Know How run these training sessions via Web Conferencing each week. We cover off Corporate Actions in Module 5 so please register to see more on the above process or to ask any questions that you may have on this. http://www.classsuper.com.au/training/registration/

Who are Super Know How

Super Know How have been intimately involved with the development of the Class Super software since its earliest stages. As such, we understand the power and inner workings of the Class Super system.

We provide many services in the SMSF space including:

- Class Super Training

- Outsourced Administration and Tax Agent services

- SMSF Audits

http://www.superknowhow.com.au

Please follow us on LinkedIn for more Class updates:

http://www.linkedin.com/company/super-know-how

Disclaimer

All data and information provided above is for informational purposes only. Super Know How makes no representations as to accuracy, completeness, currency, suitability, or validity of any information on this page and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

Comments are closed